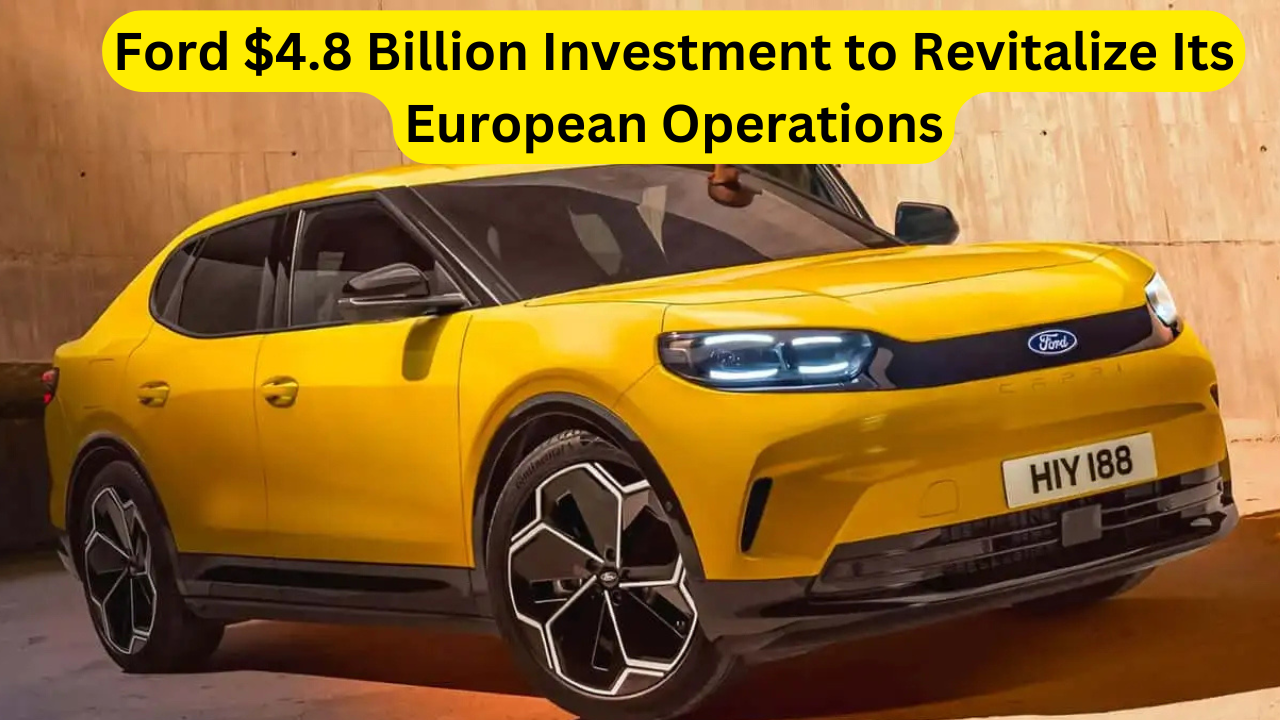

Ford $4.8 Billion Investment to Revitalize Its European Operations:Ford Motor Company has announced a major investment to transform its operations in Europe. The company plans to invest €4.4 billion ($4.8 billion) to streamline its structure, reduce costs, and increase its competitiveness in the region. This move comes as part of Ford’s ongoing effort to overhaul its European business and secure its long-term viability in the highly competitive automotive market.

Ford $4.8 Billion Investment to Revitalize Its European Operations

| Key Point | Details |

|---|---|

| Investment | €4.4 billion ($4.8 billion) |

| Focus | Restructuring Ford-Werke’s German facilities |

| Job Cuts | 2,900 jobs to be cut by 2032 |

| Challenges | Declining sales, market share drop, model phase-outs |

| Key Models | Focus on crossovers, SUVs, and commercial vehicles |

| Electric Vehicles | Two EVs, based on Volkswagen platforms |

| Goal | Simplify structures, reduce costs, and increase efficiency |

Ford’s long-term strategy is clear: reduce costs, streamline operations, and enhance its EV offerings to make a comeback in Europe. Whether the investment will lead to success depends on how quickly and effectively Ford can execute its plan.

Ford Strategy for Transformation in Europe

Ford’s investment will focus on several key areas, including reducing costs and improving operational efficiency at its Ford-Werke facilities in Germany. A major part of the transformation is a “multi-year” restructuring plan aimed at simplifying the company’s operations in the region. The company will use these funds to improve its competitive edge, which is essential for staying relevant in Europe’s evolving car market. According to Ford’s Vice Chairman, John Lawler, the automaker’s long-term success in Europe depends on improving efficiency and cutting unnecessary expenses.

A significant shift in Ford’s operations is the end of its patronage declaration in Germany, which was previously used to guarantee the liabilities of the German subsidiary. This change has raised concerns about Ford-Werke’s future, with unions like IG Metall warning that it could lead to bankruptcy within the next few years if the company doesn’t turn things around. One of the most contentious issues is the planned reduction of 2,900 jobs at Ford’s Cologne facility, although this will not happen until 2032.

Sales Decline and Market Share Loss

Ford’s European sales have faced significant challenges in recent years. In 2024, the company experienced a major drop of 87,174 units compared to 2023, which resulted in a loss of market share. Ford’s share of the European car market fell from 4.0% to 3.3%, signaling the need for drastic changes. A key factor contributing to this decline is the company’s decision to phase out popular models such as the Mondeo, Fiesta, and Ka. Additionally, the Focus, one of Ford’s staple models in Europe, is also being discontinued this year. This leaves the Mustang as Ford’s only remaining car model in Europe, with the rest of its lineup consisting of crossovers, SUVs, and commercial vehicles.

With fewer traditional car models in the lineup, Ford is shifting its focus to SUVs, crossovers, and electric vehicles (EVs), which are increasingly popular in Europe. However, this transition hasn’t been entirely smooth. The company’s EV market share in Europe saw a significant decline in 2024, and Ford needs to adapt quickly to remain competitive in this rapidly growing market.

Ford’s EV Strategy in Europe

Ford is focusing on electric vehicles as a key part of its transformation in Europe. Currently, the company offers two EV models, both of which share platforms with Volkswagen products. Although these electric cars benefit from Volkswagen’s advanced technology, Ford’s EV sales have been slower than expected. The company has seen its EV market share drop in Europe, a concerning trend given the increasing demand for electric cars.

To stay competitive in the EV market, Ford will need to accelerate the development and deployment of new electric vehicles. This will include expanding its EV lineup beyond the two existing models, as well as leveraging its global manufacturing expertise to scale up production. If Ford can deliver a broader and more diverse range of electric vehicles in Europe, it may be able to recapture lost market share and remain relevant in the evolving automotive industry.

Workforce Restructuring and Job Cuts

As part of Ford’s restructuring efforts, the company plans to reduce the workforce at its Cologne facility by 2,900 jobs, though this will not occur until 2032. This has sparked concerns among unions, particularly IG Metall, which fears that Ford may eventually be forced to shut down the facility altogether if the restructuring is not successful. The union is also concerned about the impact of job cuts on workers, especially given the uncertain future of Ford’s operations in the region.

Ford has emphasized that its restructuring is necessary to improve the company’s long-term viability in Europe, but it remains to be seen how these changes will impact the workforce. The company will likely face resistance from employees and unions as it attempts to balance cost-cutting measures with job security for its workers.

Future of Ford in Europe: What’s Next?

The $4.8 billion investment marks a critical juncture for Ford’s future in Europe. If the restructuring plan is successful, it could allow Ford to regain its footing in the European market, reduce operational costs, and improve efficiency. However, this transformation will not be easy. The company faces significant competition from both traditional automakers and new entrants in the electric vehicle market, and it will need to make substantial investments in EV technology and infrastructure to remain relevant.

One of the key challenges for Ford will be improving its EV lineup and enhancing its electric vehicle production capabilities. The shift from internal combustion engine (ICE) vehicles to electric powertrains is already well underway in Europe, and Ford must stay ahead of the curve to avoid falling behind its competitors.

Also Read: Audi A8L: A Massive Sedan That Handles Rally Stages with Ease

Ford $4.8 Billion Investment to Revitalize Its European Operations Conclusion

Ford’s €4.4 billion ($4.8 billion) investment in its European operations signals a major shift for the company as it aims to reduce costs, streamline operations, and increase competitiveness in the region. While the company faces several challenges, including declining sales, job cuts, and the need for a stronger EV presence, its investment in restructuring and innovation could provide a path forward for long-term success.

The automotive industry in Europe is rapidly evolving, and Ford must adapt to stay relevant. If it can successfully execute its multi-year restructuring plan, increase its EV offerings, and focus on streamlining operations, the company could emerge stronger in the years ahead.